mississippi income tax rate 2020

Details on how to only prepare and print a Mississippi 2021 Tax Return. These back taxes forms can not longer be e-Filed.

Mississippi House Of Representatives Votes To Eliminate Income Tax Supertalk Mississippi

Mississippi individual income tax rates vary from 0 to 5 depending upon filing status and taxable income.

. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Mississippi has a graduated income tax rate and is computed as follows.

Mississippi Income Taxes. The Mississippi tax rate and tax brackets are unchanged from last year. Title 27 Chapter 8 Mississippi Code Annotated 27-8-1 Corporate Franchise Tax Laws.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Tax Year 2020 First 3000 0 and the next 2000 3 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0 250 per 1000 of capital in excess of 100000 Tax Year 2019 225 per 1000 of capital in excess of 100000 Tax Year 2020 200 per 1000 of capital in excess of 100000 Tax Year 2021. 0 on the first 3000 of taxable income.

These income tax brackets and rates apply to Mississippi taxable income earned January 1 2020 through December 31 2020. 4 on the next 5000 of taxable income. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Read the Mississippi income tax tables for Head of Household filers published inside the Form 80. Our income tax and paycheck calculator can help you understand your take home pay. Mississippi Income Tax Forms.

You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. Taxpayer Access Point TAP Online access to your tax account is available through TAP. All other income tax returns.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022. 3 on the next 2000 of taxable income.

Divide the dollar amount in Item 6 of the state certificate by 100. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. Detailed Mississippi state income tax rates and brackets are available on this page.

Discover Helpful Information and Resources on Taxes From AARP. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Examples are 120 for 6000 190 for 9500 240 for 12000 If no exemptions are claimed enter 000.

Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Ad Compare Your 2022 Tax Bracket vs. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

Tax rate used in calculating Mississippi state tax for year 2020. The Mississippi Married Filing Jointly filing status tax brackets are shown in the table below. If you make 196500 in Mississippi what will your salary after tax be.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. While this year is a bit different for most Mississippi residents Tax Day is April 15 of each year matching up with the deadline for your federal return. Tax rate used in calculating Mississippi state tax for year 2020.

Your 2021 Tax Bracket to See Whats Been Adjusted. Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. The tax brackets are the same for all filing statuses.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Below are forms for prior Tax Years starting with 2020. Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets.

Title 27 Chapter 13 Mississippi Code Annotated 27-13-1. Mississippi residents now have until May 15 2020 to file their state returns and pay any state tax they owe for 2019. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122.

2020 Mississippi State Sales Tax Rates The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. 2020 Mississippi Tax Deduction Amounts. Mississippi Salary Tax Calculator for the Tax Year 202122.

Our calculator has been specially developed. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Corporate Income Tax Returns 2020.

2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by. 5 on all taxable income over 10000.

If you are receiving a refund. Multiply the result by 2.

Tax Rates Exemptions Deductions Dor

Where S My Refund Mississippi H R Block

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

Mississippi Income Tax Brackets 2020

Stock Market Participation Across Income Groups Stock Market Economic Analysis Marketing

Filing Mississippi State Tax Returns Things To Know Credit Karma Tax

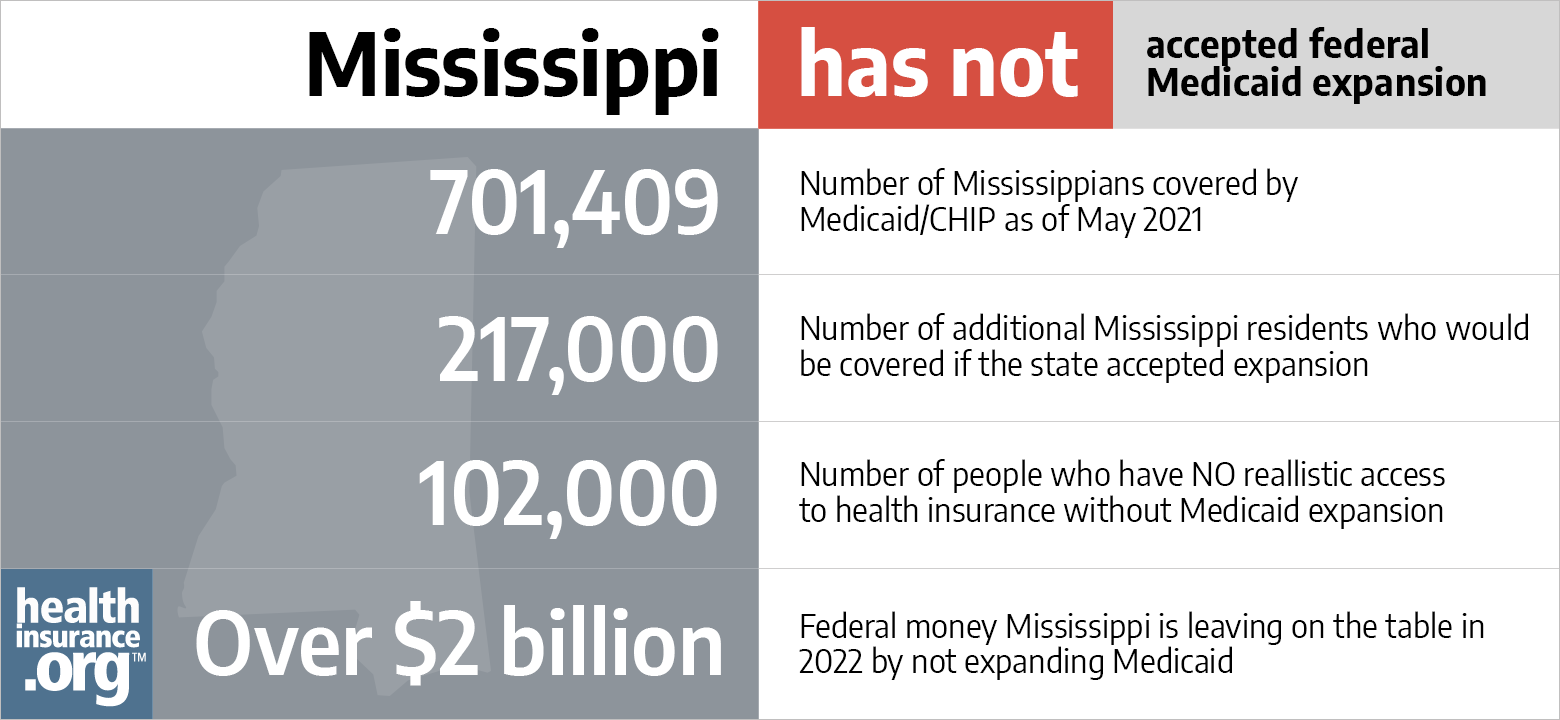

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org

Mississippi Senate To Drop Tax Reduction Plan To Eliminate 4 Income Tax Bracket Mississippi Politics And News Y All Politics

Where S My Mississippi State Tax Refund Taxact Blog

Mississippi Income Tax Calculator Smartasset

Historical Mississippi Tax Policy Information Ballotpedia

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi State Tax H R Block

Tax Rates Exemptions Deductions Dor

Florida Minimum Wage Minimum Wage Previous Year How To Plan

Mississippi Tax Rate H R Block

6 Best States To Retire Based On State Taxes Taxes Are One Of The Most Important Considerations When Choosing Among The State Tax Tax Free States Retirement